-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

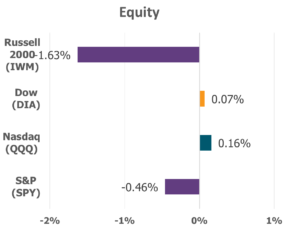

The major U.S. large-cap stock indexes climbed for the third straight week, setting new record highs and extending a steady streak of momentum. The NASDAQ led the way with a 2.3% weekly gain, lifted by strong earnings from some of its biggest technology names. The S&P 500 and the Dow each rose more than 2% for October, marking their sixth consecutive month of growth.

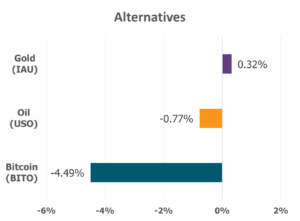

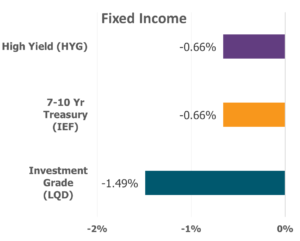

Data Source: Factset® Performance Period: 10/27/2025 to 10/31/2025

Earnings season offered another dose of encouragement. Analysts once again revised forecasts upward, now expecting S&P 500 companies to report third-quarter earnings growth of 10.7%, well above the earlier 8% estimate. The market responded as it often does when the numbers tell a stronger story—quiet confidence replacing uncertainty, even if only for a moment.

Globally, investors turned their attention to a key meeting in South Korea between President Trump and China’s President Xi Jinping on Thursday. Their agreement, a one-year truce on trade, brought a modest easing of tariffs, a suspension of export controls on rare earth materials, and a resumption of key exports such as soybeans. While not a sweeping resolution, it signaled progress, and in markets, even small steps forward can help steady the path.

The Federal Reserve added another layer of nuance to the week’s story. As expected, the central bank lowered its target rate by 25 basis points to a range of 3.75%–4.00%. Yet the vote revealed division among policymakers, a reflection of the balancing act between curbing inflation and supporting growth. Chair Jerome Powell emphasized caution going forward, reminding investors that further easing is far from certain given the lack of economic data due to the government shutdown.

Sector performance painted a varied picture, as seven of the eleven sectors finished lower. Technology and Consumer Discretionary led with gains of 3% and 2.8%. Real Estate and Materials lagged the most with -3.9% and -3.7% losses, in part due to housing affordability challenges and potential supply shifts in rare earth minerals from China.

It was a week defined by measured optimism for seeds that have been sown—a blend of progress, patience, and perspective. Markets, like faith, often move in seasons: moments of growth, moments of challenge, and moments of resilience.

“Let us not become weary in doing good, for at the proper time we will reap a harvest if we do not give up.” — Galatians 6:9

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.