-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

![]() The holiday-shortened week in the markets unfolded as a tale of rising hopes, sudden reversals, and sobering reminders of economic frailty. Most U.S. equity indexes ended higher, though the path was anything but smooth. Through Thursday, stocks advanced steadily, and Friday morning brought another lift as weaker-than-expected labor market data fueled expectations that the Federal Reserve would cut rates at its next meeting. For a moment, optimism ran high. Yet by afternoon, sentiment shifted, and much of the morning’s gains faded as doubts grew that rate cuts alone could revive slowing growth. The Nasdaq Composite rose 1.14%, powered by Apple and Alphabet, after an antitrust ruling proved less severe than feared. The S&P 500 added 0.33%, while the Dow slipped 0.32%. Smaller-cap stocks, more sensitive to interest rates, also advanced.

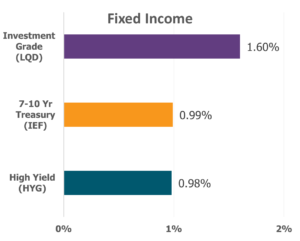

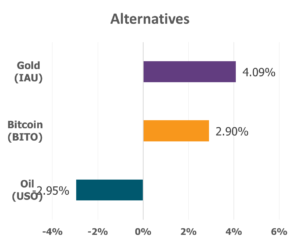

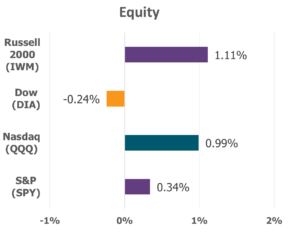

The holiday-shortened week in the markets unfolded as a tale of rising hopes, sudden reversals, and sobering reminders of economic frailty. Most U.S. equity indexes ended higher, though the path was anything but smooth. Through Thursday, stocks advanced steadily, and Friday morning brought another lift as weaker-than-expected labor market data fueled expectations that the Federal Reserve would cut rates at its next meeting. For a moment, optimism ran high. Yet by afternoon, sentiment shifted, and much of the morning’s gains faded as doubts grew that rate cuts alone could revive slowing growth. The Nasdaq Composite rose 1.14%, powered by Apple and Alphabet, after an antitrust ruling proved less severe than feared. The S&P 500 added 0.33%, while the Dow slipped 0.32%. Smaller-cap stocks, more sensitive to interest rates, also advanced.

Data Source: Factset® Performance Period: 9/1/2025 to 9/5/2025

The week’s economic data revealed deep cracks in the labor market. Friday’s non-farm payrolls report showed just 22,000 jobs added in August, well below forecasts, and June’s figures were revised into negative territory, the first decline since 2020. The unemployment rate climbed to 4.3%, its highest in four years. ADP’s private payrolls report confirmed the slowdown, while job openings fell to their lowest since 2024. For the first time since 2021, unemployed Americans now outnumber available jobs.

What once seemed to be a labor market of abundance is now showing signs of scarcity and strain. Markets adjusted quickly. Futures showed a 100% chance of at least a quarter-point cut at the Fed’s next meeting, and even the odds of a half-point cut rose. Treasury yields, already drifting lower through the week, dropped sharply Friday, pushing the 10-year yield to its lowest since April.

Sector performance reflected the turbulence. Communication Services rose 2.96%, while Consumer Discretionary gained 1.45%. Most others, including Technology and Consumer Staples, stayed flat, and Energy tumbled 3.35% under the weight of swelling oil inventories, slowing demand, and tariff uncertainty.

These numbers remind us how quickly confidence can shift and how fragile the world’s systems remain. Thankfully, Scripture assures us that while markets may shake, God’s foundation does not. “He alone is my rock and my salvation, my fortress where I will not be shaken” (Psalm 62:6). As we navigate uncertain times, may we place our hope not in headlines or central banks, but in the unchanging strength of the Lord.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.