-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

All eyes turned to May’s jobs report, searching for signs of strength in a world still reeling from tariff tremors. Much to the market’s relief, the labor market, though gradually cooling, refuses to collapse. The U.S. added 139,000 jobs, modestly topping expectations, while unemployment held at 4.2%, which is still among the lowest levels since 1948. Health care and hospitality led the charge, even as manufacturing and federal employment bore the brunt of trade policy pressures. Yes, there were blemishes, including downward revisions to prior months and a dip in labor force participation that hint at lingering fragility. But amid these shadows, light shines through. Hiring remains steady, firings remain rare, and wage growth continues to outpace inflation, a quiet testament to resilience.

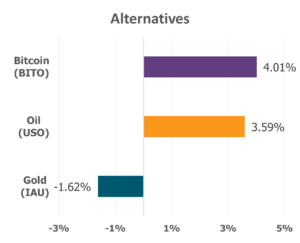

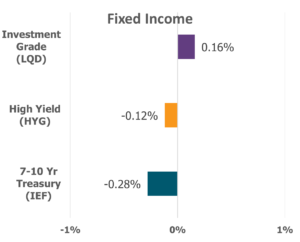

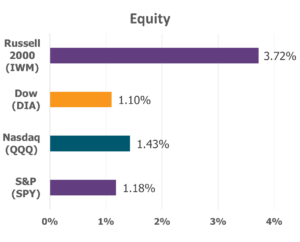

Data Source: Factset® Performance Period: 6/2/2025 to 6/6/2025

Corporate America, too, delivered a reassuring note. S&P 500 earnings climbed 12.5% year-over-year, marking a third straight quarter of double-digit profit growth. Though 2025 earnings expectations have been trimmed, the 2026 outlook remains firm, and forward 12-month earnings just hit a record high. That foundation of strength has helped lift the markets not on hype alone, but on hard-earned results. A surge in demand ahead of tariff hikes may have front-loaded some gains, but the rally was led by true growth engines. Technology, communication services, and consumer discretionary, sectors that once fell out of favor, roared back with 20%, 33%, and 8% earnings growth, respectively. In uncertain times, these pillars of innovation are helping restore confidence.

Among those leading this charge is KLA Corporation, an unsung hero in the semiconductor world, who is quietly exceeding expectations while equipping the infrastructure behind the AI revolution. As demand surged ahead of tariff hikes, KLA stood ready, providing advanced process control and yield management solutions to giants like TSMC and Samsung. In the first quarter, the company delivered a 29.8% year-over-year revenue increase, reaching $3.06 billion and beating Wall Street’s forecasts. This growth was fueled by rising needs for tools that power next generation chipmaking and AI technologies. KLA’s forward guidance reflects more than just market resilience, it reflects steady hands at the helm and a long-term vision grounded in purpose.

Through every revision and every market ripple, we’re reminded: God’s hand steadies what feels uncertain. ”And my God will supply every need of yours according to His riches in glory in Christ Jesus.” – Philippians 4:19Even when clouds gather, the path forward is lit by faith, perseverance, and the promise that He is working all things together for good.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.