-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

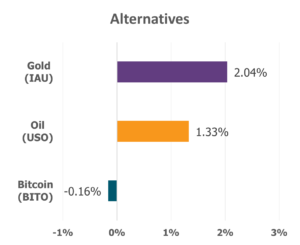

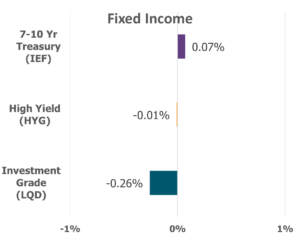

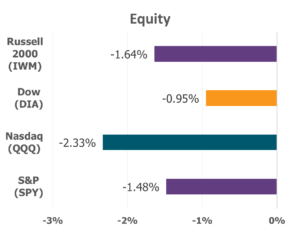

Last week, the major U.S. indices continued their descent, weighed down by growing investor unease over trade policy ambiguity and stubborn inflation signals. Amid the pullback, Consumer Staples emerged as the lone bright spot within the S&P 500, while Technology, Communication Services, and Industrials bore the brunt of the losses. Though the outlook remains shrouded in uncertainty, it’s in times like these that long-term investors can look to their trusted advisor for guidance in unsteady markets.

Data Source: Factset® Performance Period: 3/24/2025 to 3/28/2025

The economic calendar delivered a mixed bag of signals. It began on a sour note with consumer confidence slipping to its lowest level in over four years, casting a shadow on discretionary spending potential. In housing, February’s new and pending home sales showed modest improvement over January’s figures, with pending sales driven largely by activity in the South and Midwest. However, year-over-year comparisons painted a different picture, with pending sales down 3.6%. Meanwhile, initial jobless claims came in just below forecasts, suggesting a still-resilient labor market. Friday’s inflation reading brought February’s Personal Consumption Expenditures (PCE) in line with expectations. Yet Core PCE, the Fed’s preferred inflation gauge that strips out food and energy, came in slightly hotter than forecasted. Personal income surprised to the upside with a robust 0.8% rise, but consumers appear to be tightening their wallets, with spending falling short of expectations. Rounding out the week, consumer sentiment for March also missed the mark.

Looking ahead, the spotlight shifts to the labor market and industrial production. Reports on construction spending, factory orders, and manufacturing will offer deeper insight into business activity. A slate of employment data, including job openings, ADP payrolls, initial claims, and the U.S. employment report, will illuminate the condition of the labor engine that drives the broader economy. Although the next FOMC rate decision is slated for early May, these metrics remain top of mind for Fed policymakers.

Despite recent volatility fueled by shifting valuations and conflicting economic signals, some companies continue to exemplify long-term potential through talented execution and visionary leadership. Take Xometry, a standout in the world of advanced manufacturing. The stock has soared nearly 50% over the past twelve months. The company specializes in producing custom plastic and metal components for companies like BMW, Dell, and NASA. Xometry’s most recent earnings call told a compelling story: a 16% increase in revenue and a 20% rise in gross profit, with earnings per share beating expectations by a wide margin. Looking ahead, the company anticipates accelerating demand, buoyed by global expansion and technological innovation. By harnessing artificial intelligence, Xometry is refining its quoting process, making custom manufacturing more efficient, accessible, and precise. At its core, its mission is a testament to human ingenuity. Its work echoes the spirit of divine craftsmanship described in Ephesians 2:10: “For we are God’s handiwork, created in Christ Jesus to do good works, which God prepared in advance for us to do.”

In a world defined by uncertainty, such innovation offers a hopeful reminder of what’s possible when talent, technology, and vision converge.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.