-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

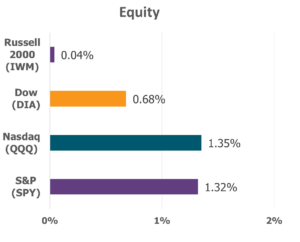

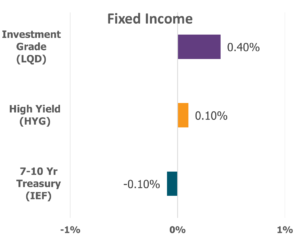

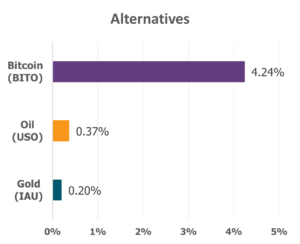

The markets surged to new heights this week, as the Federal Reserve delivered its first rate cut in nine months and sent waves of renewed energy through Wall Street. Small-cap stocks, often more vulnerable to the winds of interest rate shifts, leapt forward, with the Russell 2000 gaining 2.16%. The Nasdaq Composite soared 2.21%, while the S&P 500 and Dow Jones Industrial Average climbed 1.22% and 1.05%, respectively.

Data Source: Factset® Performance Period: 9/15/2025 to 9/19/2025

The central event on the economic stage was Wednesday’s conclusion of the Fed’s two-day policy meeting. As widely anticipated, officials unveiled a quarter-point cut, marking the first adjustment since December 2024. Yet, discord lingered in the process, as newly appointed Fed Governor Stephen Miran broke ranks, pressing for a deeper 0.5% cut in light of rising economic pressures. Policymakers openly acknowledged what many had already discerned—that the labor market is softening, job gains have slowed, and the risks to employment have grown heavier.

But with the Fed decision behind them, investors turned their gaze toward the horizon, searching for signs of what may yet unfold. The Fed’s projections revealed that most policymakers foresee an additional 50 basis points of easing before year’s end, signaling a more generous hand than previously forecast. Projections for 2026 and 2027 also hinted at greater leniency, leaving markets pondering the long arc of monetary policy.

Meanwhile, economic data painted a picture of both strength and strain. Retail sales offered a bright spot, climbing 0.6% in August and marking the third consecutive month of growth—evidence of resilience in the face of uncertainty. Yet the housing market faltered, with housing starts tumbling 8.5% and builder sentiment remaining subdued, though faint glimmers of hope shone through in expectations for stronger sales ahead, fueled by falling mortgage rates.

Sectors told their own stories: Communication Services and Technology led with powerful gains of 3.4% and 2.1%, fueled by innovation and digital resilience. Consumer Discretionary and Industrials crept forward with modest steps, while Consumer Staples and Real Estate stumbled under the weight of weakened confidence, tariff pressures, and enduring affordability challenges.

Such movements remind us that the ripples of the market—like the currents of life—are ever shifting, often beyond our control. Rate cuts and policy shifts may steady the waters for a moment, yet they cannot guarantee lasting peace or security. For that, we must look higher, anchoring our trust not in the wisdom of man or the projections of policymakers, but in the unchanging promises of God.

“Trust in the Lord with all your heart, and do not lean on your own understanding. In all your ways acknowledge Him, and He will make straight your paths.” — Proverbs 3:5–6

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.