-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

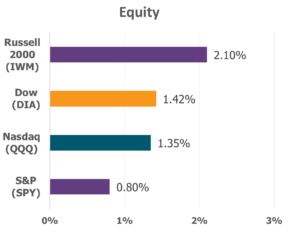

Major U.S. stock indexes closed the first week of December on higher ground, continuing the upward stride from late November. Investor hope swelled once again, stirred by rising expectations that the Federal Reserve may finally deliver a “long-awaited” interest rate cut at its upcoming meeting. The technology-heavy Nasdaq Composite led the charge with a 0.91% gain, followed closely by the small-cap Russell 2000’s 0.84% rise. Even the S&P 500, though more restrained, managed to join the path upward.

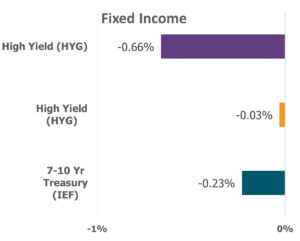

Data Source: Factset® Performance Period: 12/1/2025 to 12/5/2025

Yet beneath the surface of market optimism, the real economy painted a more complex picture. The manufacturing sector contracted for a ninth consecutive month, with the ISM’s Manufacturing PMI dipping to 48.2%, another reminder that portions of the economy are still stumbling under lingering pressures. Supplier deliveries, new orders, and employment all retreated, and input prices continued their steady upward march for the fourteenth month in a row. In contrast, the services sector offered a glimmer of steadiness, expanding at its fastest pace in nine months. The Services PMI inched up to 52.6%, and while prices remained elevated, the slowing rate of increase offered a small breath of relief.

Labor market signals were equally mixed. ADP reported a 32,000 decline in private-sector payrolls, the largest drop since March 2023, highlighting the challenges facing employers navigating uncertain consumer behavior and a shifting macroeconomic landscape. Job-cut announcements surged as well, reaching over 71,000 for November and pushing the year-to-date total beyond 1.17 million. Yet in a surprising turn, weekly unemployment claims fell sharply to 191,000, the lowest level since September 2022. Inflation data, too, remained steady. The Fed’s preferred metric, the PCE index, rose 0.3% in September, mirroring August’s pace. Core PCE increased 0.2%, bringing both year-over-year figures to 2.8%. The release of subsequent data is still delayed due to the recent government shutdown, leaving markets waiting for the next chapter of clarity.

The sectors overall had extremely modest gains this past week with Technology and Energy both gaining 1.4%. Meanwhile Utilities and Health Care saw sharp declines at -4.5% and -2.7% respectively, with the decline in Utilities due to energy companies failing to deliver on massive data center deals that align with investor expectations.

Through all these mixed signals—markets rising, sectors wavering, consumers adjusting, and employers recalibrating—we are reminded that human foresight, while valuable, is always limited. Markets shift, economic data surprises, and forecasts evolve. Yet the Lord continues to guide faithfully, setting our steps on solid ground even when the path ahead appears uncertain.

“In their hearts humans plan their course, but the Lord establishes their steps.” — Proverbs 16:9 (NIV)

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.