-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

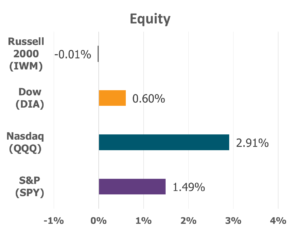

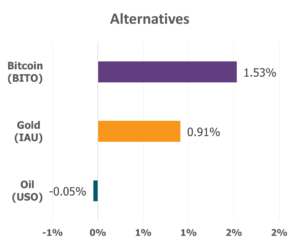

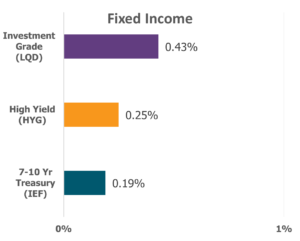

The financial markets navigated a mixed yet largely positive trajectory last week, reflecting both sectoral strengths and economic shifts. S&P 500’s sectoral winners included Consumer Staples and Information Technology leading the charge, while Consumer Discretionary and Financials lagged behind. Amidst this dynamic backdrop, a wave of economic reports, largely pointing to continued inflation, provided deeper insights into business sentiment, inflation, and labor market resilience.

Data Source: Factset® Performance Period: 2/10/2025 to 2/14/2025

Economic data played a central role in shaping market sentiment. The NFIB Small Business Optimism Index for January fell short of expectations, landing at 102.8, with businesses citing hiring difficulties as a persistent challenge. Meanwhile, retail sales took a hit, dropping 0.9% in January, and business inventories contracted by 0.2% in December. However, there was a glimmer of optimism, as initial jobless claims came in below estimates at 213,000, reinforcing the labor market’s strength. Inflation, however, continues to test the Federal Reserve’s patience. January’s Consumer Price Index (CPI) rose 0.5%, bringing the annual increase in consumer prices to 3%—notably above the Fed’s ideal 2% target. Even the Core CPI, which excludes volatile food and energy prices, climbed 0.4% on a monthly basis, marking a 3.3% annual increase. Meanwhile, the Producer Price Index (PPI), an indicator of input cost inflation, jumped 0.4%, with Core PPI up 0.3%—reflecting yearly increases of 3.5% and 3.4%, respectively. Adding to inflationary concerns, egg prices soared to a record high due to supply constraints. As these inflationary pressures persist, the Federal Open Market Committee (FOMC) remains vigilant, balancing economic growth with price stability.

This week began on a quieter note as markets observed Presidents’ Day, honoring George Washington’s birthday. The remainder of the week, however, will be rich with housing market updates. The home builder confidence index will provide a forward-looking assessment from builders, followed by reports on housing starts and building permits—both key indicators of future demand for new construction. The week will conclude with existing home sales data, offering insights into current market conditions. Additionally, investors will keep a close eye on leading economic indicators, which aggregate multiple data points to gauge the economy’s future direction.

On the corporate front, earnings season is in full swing, and one standout performer is Shopify. The e-commerce giant delivered a stellar earnings report, buoyed by its most successful Black Friday and Cyber Monday period yet. With an impressive 31% year-over-year revenue growth, disciplined financial management, and expanding international presence, Shopify’s future appears bright. Since the start of the year, its stock has climbed over 19%, underscoring investor confidence. Beyond strong financials, Shopify boasts a commanding market share of at least 12%, with approximately one-sixth of all Internet users having purchased through its merchants’ stores. A key driver of Shopify’s success lies in its proactive approach—anticipating the needs of both merchants and consumers. By simplifying customer retention tools and enhancing online and offline transaction experiences, the company continues to redefine the e-commerce landscape.

Given market trends, economic indicators, and corporate performances, the quest for financial stability and growth remains a delicate balancing act. Yet, amid the ever-changing economic landscape, wisdom and patience remain invaluable. As Proverbs 21:5 reminds us, “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.”

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.