-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

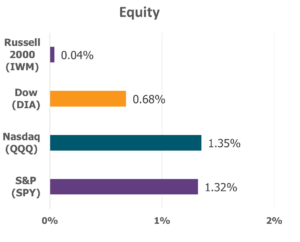

The tide of the markets swelled higher this past week, carrying major U.S. stock indexes to new heights even as eyes turned toward the Federal Reserve’s upcoming September 16–17 meeting. Anticipation runs deep, because the Fed is widely expected to lower short-term interest rates, a decision that could ripple across the economy. Layered upon this expectation is the ongoing surge of artificial intelligence. Oracle’s announcement of a major guidance increase, fueled by several large AI-driven deals, stirred fresh enthusiasm and helped propel the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite to record highs. By week’s end, however, the Dow and S&P pulled back modestly in a quieter Friday session, while the Russell 2000 pressed forward to notch its sixth consecutive week of gains.

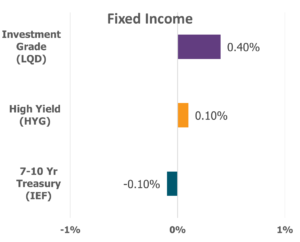

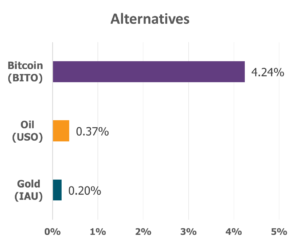

Data Source: Factset® Performance Period: 9/8/2025 to 9/12/2025

Markets also braced themselves for the latest consumer price index (CPI) report, knowing its numbers could weigh heavily on the Fed’s next step. The August report revealed inflation rising to 2.9% annualized, up from 2.7% the month prior, largely driven by energy costs with gasoline climbing 1.9% alone. Yet beneath these shifting currents, core CPI held steady at 3.1%, right in line with expectations. Inflation remains above the Fed’s 2.0% target, but the central bank appears ready to resume interest rate cuts for the first time this year, striving to balance its mandate of maximum employment. Though labor demand has cooled, the unemployment rate held at 4.3%, still well below its historical average of 5.7%. Alongside its policy move, the Fed is also set to unveil fresh quarterly projections on growth, inflation, unemployment, and the path of rates.

The bond market responded in kind. The 10-year U.S. Treasury yield fell for a fourth straight week, dipping below 4.00% for the first time in over five months. By Friday, it closed at 4.06%, down notably from its July peak of 4.49%. Such moves point to growing confidence in easing policy and renewed hope for economic steadiness.

Sector performance told its own story. Technology, bolstered by AI’s strong performance, surged 2.76%, while utilities climbed 2.22%, proving to be the week’s brightest performers. At the other end, consumer staples slipped 0.4% and industrials barely moved, gaining only 0.04%.

Although we’ve been blessed with a fruitful year, we understand that markets will rise and fall, inflation will ebb and flow, and forecasts will change with the seasons. These facts are all the more reason to anchor ourselves in the Lord to find a steadiness not subject to the turmoil of the times. “Those who trust in the Lord are like Mount Zion, which cannot be shaken but endures forever” (Psalm 125:1). As investors wait on the Fed’s next word, may we rest in the greater Word that endures forever.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.