-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

![]() In a week painted with optimism, each of the major U.S. indexes ascended nearly 2%, building upon previous momentum. The S&P 500, NASDAQ, and Dow Jones all reached new record highs— a testament to the market’s enduring spirit amid uncertainty. Though headlines rumbled with news of U.S.–China trade tensions and sanctions on Russia’s largest oil companies, investors pressed forward. The bull market, now three years old, stands as a monument to perseverance, having risen from the ashes of October 2022 when stocks fell nearly 25% under the weight of peak inflation.

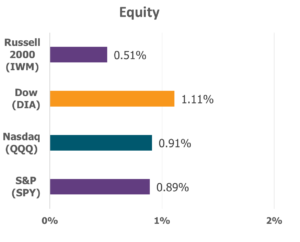

In a week painted with optimism, each of the major U.S. indexes ascended nearly 2%, building upon previous momentum. The S&P 500, NASDAQ, and Dow Jones all reached new record highs— a testament to the market’s enduring spirit amid uncertainty. Though headlines rumbled with news of U.S.–China trade tensions and sanctions on Russia’s largest oil companies, investors pressed forward. The bull market, now three years old, stands as a monument to perseverance, having risen from the ashes of October 2022 when stocks fell nearly 25% under the weight of peak inflation.

Data Source: Factset® Performance Period: 10/20/2025 to 10/24/2025

Even amid a government shutdown that silenced much of the usual economic chatter, one vital report found its way through: Inflation. Released belatedly by the Bureau of Labor Statistics, September’s numbers revealed a 3.0% rise in headline inflation, just shy of forecasts but steady enough to offer reassurance. Core inflation, excluding the volatile swings of food and energy, matched the headline figure, suggesting a quieting of past storms.

Meanwhile, early readings from S&P Global’s purchasing managers’ indexes (PMIs) offered a hopeful melody. Business activity strengthened in October, with the composite PMI rising to 54.8—marking thirty-three consecutive months of expansion. The service sector led this charge, while manufacturing, though modest in growth, reflected the steadfast hands of industry. Yet not all was tranquil: manufacturers’ optimism wavered, weighed down by the shadows of tariffs and policy uncertainty.

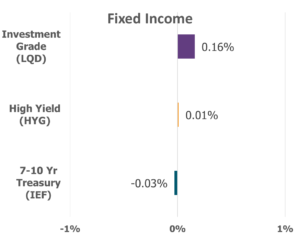

Treasury yields mirrored the market’s cautious rhythm, drifting lower before edging higher ahead of inflation data. Short-term yields rose; long-term yields slipped—a quiet reminder that patience often pays its own reward. Traders watched closely, wary that the government shutdown’s persistence might yet shape the course of monetary policy and market expectations.

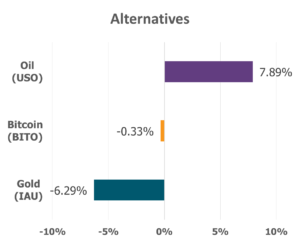

In last week’s closing act, Technology and Energy sectors shone brightest. Energy was buoyed by the geopolitical ripples of new Russian sanctions, while most other sectors followed suit in quiet harmony. Only Consumer Staples and Utilities lagged slightly, symbols of caution in an otherwise confident march.

Through it all, the market moved not merely in numbers, but in faith: faith in resilience, in recovery, and in the unseen rhythm of renewal that beats beneath the surface of uncertainty.

“But those who hope in the Lord will renew their strength; they will soar on wings like eagles; they will run and not grow weary; they will walk and not be faint.” — Isaiah 40:31 (NIV)

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.