-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

Markets were once again engulfed in a storm of volatility last week, stirred by fresh geopolitical tremors and deepening uncertainty within the tech sector. The epicenter of the selloff struck midweek, when semiconductor stocks unraveled under the weight of newly announced U.S. export restrictions to China. Though the policy included some carveouts, it rattled the foundation of an already-tense AI race, sending ripples through Wall Street.

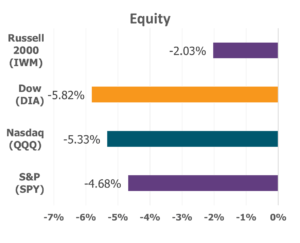

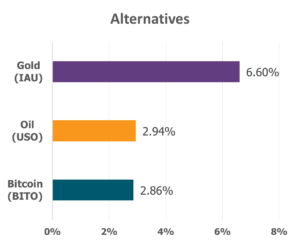

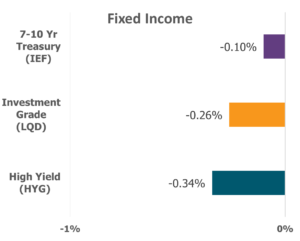

Data Source: Factset® Performance Period: 4/18/2025 to 4/18/2025

In a stinging revelation, Nvidia disclosed that it would now require licenses to export its advanced H200 AI chip to China—an adjustment that could cost the company $5.5 billion. AMD, facing similar constraints, warned of up to $800 million in associated losses. Markets responded swiftly: AMD shares tumbled 6%, while the broader chip landscape followed suit. The VanEck Semiconductor ETF (SMH) plunged nearly 4%, Micron fell 3%, and ASML’s U.S.-listed shares dropped more than 5% following a lackluster earnings release.

As the tech tremors echoed through markets, Federal Reserve Chair Jerome Powell added a layer of uncertainty with a candid assessment of the Fed’s position. He warned of a precarious balancing act—caught between the need to contain inflation and the obligation to support a fragile economy. “For the time being,” Powell noted, “we are well positioned to wait for greater clarity before considering any adjustments to our policy stance.” But the undertone was unmistakable: a policy crossroads looms.

Looking Ahead: Hoping for Calm Beyond the Storm

As recession concerns continue to swirl, investors now turn their eyes toward a pivotal lineup of upcoming data: New Home Sales, Consumer Sentiment, Durable Goods Orders, and Leading Economic Indicators. With little clarity from the Fed and markets moving in crosscurrents, any sign of direction—a pathway in the sand—will be closely watched.

Hope in the Havoc: Palantir’s Path Forward

While many tech names sunk in the sand, one firm stood tall. Palantir Technologies, the Denver-based defense-tech trailblazer, saw its stock rise 4.6% this week after NATO finalized a groundbreaking deal to deploy Palantir’s Maven Smart System—an AI-powered platform for real-time military awareness and target analysis. Though details of the deal were kept under wraps, NATO confirmed that deployment will begin within 30 days.

Guided by CEO Alex Karp’s unorthodox vision, Palantir has earned a reputation for delivering high-stakes, data-driven decision tools to those charged with mission-critical operations. With $1.57 billion in U.S. government contracts booked in 2024 and a growing footprint in defense innovation, the company appears poised to lead in the AI era of national security. Amid a storm of uncertainty, Palantir is not just surviving—it is forging ahead.

Faith Over Forecasts

In the ever-shifting sands of global markets, it’s easy to feel overwhelmed by headlines, numbers, and uncertainty. Just as Christ calmed the winds and waves with a word, so too can He steady our hearts when financial storms rage. Our calling is not to fear the unknown but to walk by faith, knowing that God’s sovereignty stretches over both the peaks and valleys of this life—including the markets. In times like these, let us lean not on our own understanding, but in all our ways acknowledge Him, trusting that He will make our paths straight (from Proverbs 3:5-6).

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.