-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

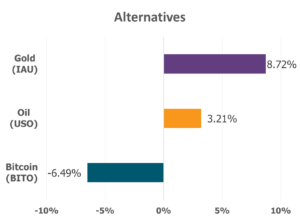

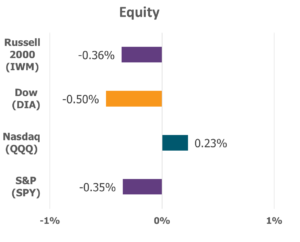

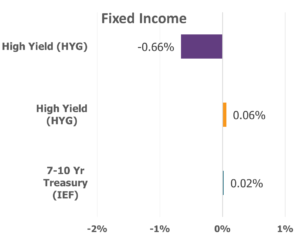

Major equity indexes ended a volatile, holiday-shortened week modestly lower, reminding investors that, even in strong seasons, markets are not immune to sudden tremors. The S&P MidCap 400 Index led the declines, falling -0.55%, followed closely by the Dow Jones Industrial Average and the S&P 500, which slipped -0.53% and -0.35%, respectively. The Russell 2000 gave back -0.32%, while the Nasdaq Composite finished only slightly in the red. U.S. markets were closed Monday in observance of Martin Luther King Jr. Day, compressing trading into a shorter and more reactive week.

Data Source: Factset® Performance Period: 1/19/26 to 1/23/26

Uncertainty surfaced quickly on Tuesday, as stocks sold off sharply following renewed concerns over a global trade dispute. Markets reacted swiftly after the administration announced plans to impose new tariffs on European nations opposing U.S. involvement with Greenland. The S&P 500 recorded its largest single-day decline since October, as investors weighed the potential consequences. Yet, as has often been the case, the tone shifted just as quickly. By Wednesday sentiment improved, after the President indicated that talks with NATO leadership had produced a framework for cooperation and that the proposed tariffs would no longer take effect. Stocks rebounded on the news, finishing the week well above their lowest levels.

Economic data offered a steadier backdrop. The Bureau of Economic Analysis revised third-quarter U.S. GDP growth higher, reporting a 4.4% annualized pace—surpassing both the prior estimate and the second quarter’s growth rate. Stronger exports and investment drove the upward revision, reinforcing the economy’s underlying momentum. Inflation data, however, continued to signal restraint rather than retreat. The Federal Reserve’s preferred inflation gauge, core PCE, rose 0.2% in November and 2.8%, year over year—still above the Fed’s long-term target, but consistent with recent trends.

Labor market data reflected ongoing resilience. Initial jobless claims edged slightly higher but remained historically low, bringing the four-week moving average to its lowest level in two years. Continuing claims declined as well, suggesting layoffs remain limited despite signs of cooling. At the same time, consumer sentiment showed modest improvement in January, though confidence remains meaningfully lower than a year ago, as households continue to feel the weight of higher prices and uncertainty around employment.

Business activity data added another layer of perspective. S&P Global reported that overall U.S. economic activity ticked higher in January, led by accelerating growth in manufacturing and reflected in the Energy and Materials sectors, with gains of 3.1% and 2.6%, respectively. Real Estate and Financials continued to see losses of -2.4% and -2.5%.

Weeks like this serve as a reminder that markets often test patience before rewarding prudence. Headlines may stir anxiety, and short-term swings can feel unsettling, but steadiness—anchored in wisdom and perspective—remains a powerful ally. In moments of fluctuation, faith offers something markets cannot: assurance that calm can coexist with uncertainty, and that endurance has lasting value.

“The Lord gives strength to his people; the Lord blesses his people with peace.”

— Psalm 29:11

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.