-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

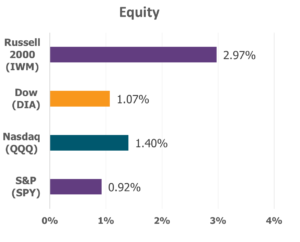

Equities opened the new year in convincing fashion, as investors largely set aside mounting geopolitical tensions and focused instead on momentum, opportunity, and renewal. Most major indexes surged to fresh all-time highs, signaling that confidence, not fear, set the tone as calendars turned and expectations reset. Leadership within the market broadened notably. Small-cap and value-oriented stocks outpaced the large-cap growth names that have dominated returns in recent years, while an equal-weighted version of the S&P 500 outperformed its market-cap-weighted counterpart. This is an encouraging sign of participation beneath the surface. The Russell 2000 led the charge with a robust 4.62% gain, while even the lagging S&P 500 managed a respectable advance of 1.57%.

Data Source: Factset® Performance Period: 1/5/26 to 1/9/26

Policy developments added drama and volatility at the industry level. Aerospace and defense stocks stumbled midweek, after comments from the administration suggested limits on dividends and share buybacks unless production of military equipment accelerated. Yet, almost as quickly as sentiment soured, it reversed. A subsequent proposal for a substantial increase in military spending sparked a rally, as investors recalibrated expectations for future government outlays. Housing-related stocks experienced a similar test of resolve. Initial pressure followed announcements aimed at curbing institutional ownership of single-family homes. However, optimism returned later in the week when Fannie Mae and Freddie Mac were directed to purchase $200 billion in mortgage-backed securities, a move designed to ease lending rates. Credit spreads tightened rapidly, reflecting renewed confidence in housing finance and policy support.

Economic data releases offered a more measured reminder that strength and softness often coexist. Labor market reports surprised modestly to the downside. December non-farm payrolls showed job growth of just 50,000, below expectations, and prior months were revised lower. Yet the unemployment rate edged down to 4.4%, underscoring continued resilience beneath the headline figures. Additional reports from private payrolls processing firm ADP pointed to a cooling, but not collapsing, labor environment – one that may provide the Federal Reserve greater flexibility in the months ahead.

Sector performance reflected renewed optimism. Apart from Utilities and Technology, all sectors finished the week higher. Consumer Discretionary and Materials led the way, rising 5.8% and 4.8%, respectively, lifted by strong chip stock performance and growing hopes that softer labor data could pave the way for future rate cuts.

As the year begins, markets remind us that renewal is rarely quiet. It often arrives amid uncertainty, testing conviction before rewarding patience. For long-term investors, this season reinforces an enduring truth: progress is built on steady faith, disciplined stewardship, and confidence that even shifting circumstances can be used for good.

“Now faith is the assurance of things hoped for, the conviction of things not seen.”

— Hebrews 11:1

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.