-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

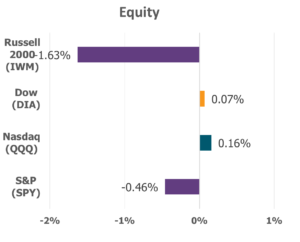

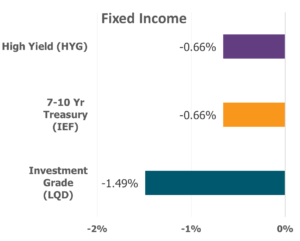

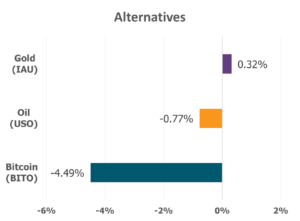

Last week reminded investors and observers alike that even in seasons of progress, uncertainty can stir at a moment’s notice. U.S. equity indexes finished lower, as concerns over elevated valuations and renewed scrutiny of artificial intelligence spending weighed on the growth stocks that have propelled markets since early spring. The technology-heavy Nasdaq Composite led the decline, while growth shares underperformed their value peers by the widest margin in months.

Data Source: Factset® Performance Period: 11/3/2025 to 11/7/2025

Beyond the charts and tickers, the nation’s longest-running government shutdown added to the sense of unease. For weeks, headlines had been dismissed as background noise—but, this time, the reverberations grew louder. The Federal Aviation Administration urged airlines to scale back flights due to staffing shortages, and the absence of key government data left analysts navigating without familiar guides. The uncertainty was not only economic, it was emotional, testing the collective confidence of a weary marketplace.

Private-sector reports stepped in to fill the key data void. ADP’s October employment data offered a modest rebound, with 42,000 new jobs added after two months of decline. Yet, the recovery was uneven: industries like business services and leisure continued to shed workers, and wage growth held flat. Challenger, Gray & Christmas painted a starker picture—reporting over one million jobs being cut this year, a sobering 65% increase from 2024’s pace. Consumer confidence, too, faltered. The University of Michigan’s sentiment index fell to its lowest level since mid-2022, as worries over inflation and the prolonged shutdown eroded household outlooks.

Yet, amid these clouds, there were rays of resilience. The Institute for Supply Management reported that the services sector—so often the heartbeat of the U.S. economy—had returned to growth, with new orders climbing to their strongest levels in a year. Even as manufacturing remained in contraction, the services rebound stood as quiet evidence that strength endures in unexpected places.

It is in weeks like this—when headlines stir anxiety and data seem uncertain—that faith calls us to lift our eyes from what shifts to the One who stands still. Markets rise and fall; sentiment waxes and wanes. But God’s peace is not contingent on performance—it is promised to those whose minds are steadfast, anchored not in circumstance but in trust.

Perfect peace does not mean perfect conditions. It means a perfect Savior, whose faithfulness outlasts every fluctuation.

“You will keep in perfect peace those whose minds are steadfast, because they trust in You.” — Isaiah 26:3

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.