-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

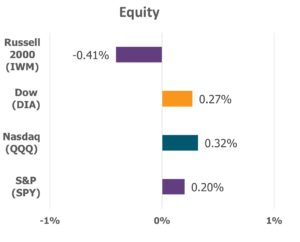

The markets found their footing last week, rising from the shadows of the previous Friday’s sharp decline and the S&P 500’s worst day since April. What began as a week of uncertainty turned into one of renewed strength, as investors witnessed a steadying of nerves and a hint of restored confidence. Early optimism took root when representatives from the U.S. and China appeared to soften their tone, easing some of the strain from last week’s trade tensions. That spirit of reconciliation, paired with reassuringly measured comments from Federal Reserve officials and a string of promising announcements in the ever-expanding world of artificial intelligence, breathed new life into the markets.

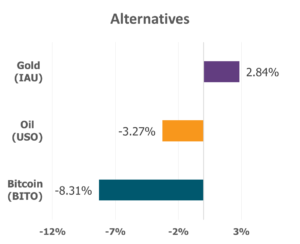

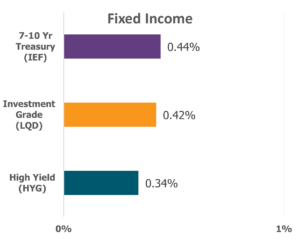

Data Source: Factset® Performance Period: 10/13/2025 to 10/17/2025

Earnings season also arrived in full force. By week’s end, roughly 12% of S&P 500 companies had reported results—and an encouraging 86% exceeded expectations. Major banks led the charge, helping lift investor sentiment after weeks of uncertainty. Yet, as the week unfolded, reality reminded markets of their fragility. Reports of loan irregularities at two regional banks, combined with recent bankruptcies in the subprime lending and auto sectors, stoked concerns about the health of credit markets and regional banking stability. The tremors of those fears rippled through Wall Street, pushing the CBOE Volatility Index, which measures expected stock market volatility over the next 30 days, to its highest level since April.

Still, amid the uncertainty, a sense of steady guidance seemed to emerge from the Federal Reserve. Chair Jerome Powell signaled that, despite persistent inflation, the central bank remains poised to ease borrowing costs once more before year’s end, acknowledging the growing risks to employment and economic balance. The Fed’s Beige Book echoed a theme of mixed endurance: steady jobs and rising wages, offset by softening consumer spending and quiet layoffs.

Through the fluctuations—gains and losses, confidence and caution—one theme remained constant: resilience. Every sector, except for Financials, found its footing, with Communication Services soaring 3.6% and Real Estate reclaiming ground with a 3.5% advance. It was a reminder that, though the markets may tremble, recovery often waits just beyond the quake.

In times of shaky footing, financial or otherwise, faith reminds us where true stability lies: not in the peaks and valleys of indexes, but in the steadfastness of God’s hand guiding us through.

“He alone is my rock and my salvation; He is my fortress, I will not be shaken.”

— Psalm 62:6 (NIV)

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.