-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

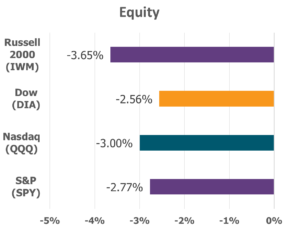

Last week’s market activity reflected a world wrestling with uncertainty. U.S. stock indexes declined, weighed down by renewed fears of escalating global trade tensions and the ongoing strain of a prolonged government shutdown. The Nasdaq Composite and S&P 500 began the week with promise, lifted by continued enthusiasm surrounding companies tied to artificial intelligence. A new strategic partnership between Advanced Micro Devices and OpenAI sparked excitement and, for a moment, optimism reigned.

Data Source: Factset® Performance Period: 10/6/2025 to 10/10/2025

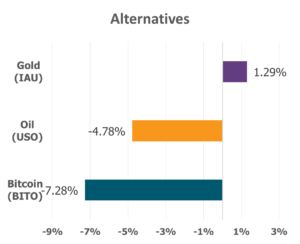

But as quickly as confidence rose, it faltered. On Friday morning, markets turned sharply lower after President Donald Trump announced consideration of “a massive increase of tariffs on Chinese products,” responding to China’s proposed export controls on rare earths. The sudden threat of heightened trade conflict sent investors fleeing toward safety, driving gold prices to record-breaking heights—surpassing $4,000 per ounce for the first time in history. In that rush to perceived security, we are reminded how quickly earthly treasures can dazzle and distract, yet how fleeting their assurance truly is.

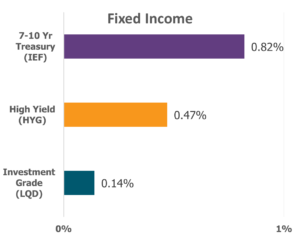

Meanwhile, the absence of key economic data amid the ongoing shutdown left investors scanning the Federal Reserve’s September meeting minutes for guidance. The report revealed a divided committee—leaders grappling with the tension between persistent inflation and a weakening labor market. Some policymakers urged further easing to support growth, while others urged restraint, cautioning that monetary policy might not yet be restrictive enough. It was a picture of human deliberation, uncertainty, and imperfect foresight—a mirror of our own struggle to discern direction when the road ahead feels unclear.

Elsewhere, the University of Michigan’s preliminary October Index of Consumer Sentiment remained largely unchanged, holding at 55. Consumers’ confidence in near-term finances showed slight improvement, even as expectations for future conditions wavered. Inflation expectations inched modestly lower from 4.7% to 4.6% in September, with long-run inflation expectations remaining at 3.7%.

Sectors this week did not fare well due to a combination of factors, including the above-mentioned trade tensions, concerns over AI stock valuations and the ongoing government shut down. Utilities and Consumer Staples were the only sectors that held on to slight gains, at 1.4% and 0.6% respectively. Consumer Discretionary and Real Estate led the losses, both at -3.3%.

In such moments, when the world’s markets fluctuate and fear rises like the tide, we are called to remember where our true foundation lies. It is not in the fleeting value of gold, nor in the shifting signals of economic policy—but in the steadfast faithfulness of God, who remains unmoved by the storms of man. When uncertainty grips the world, believers are invited to rest not in circumstance, but in the certainty of His promise.

“Command those who are rich in this present world not to be arrogant nor to put their hope in wealth, which is so uncertain, but to put their hope in God, who richly provides us with everything for our enjoyment.”

— 1 Timothy 6:17 (NIV)

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.