-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

![]() The week in the markets closed with a weight of uncertainty, as major U.S. stock indexes drifted lower under the shadow of hawkish voices from the Federal Reserve. Hopes for swift and generous interest rate cuts dimmed, leaving investors restless. The Nasdaq bore the heaviest decline, falling 0.65%, while the Russell 2000 stumbled with its first weekly loss since early August. The S&P MidCap 400 and S&P 500 followed suit, while the Dow Jones Industrial Average held almost steady, though not untouched by the tremors.

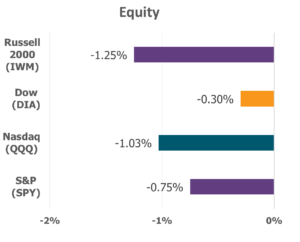

The week in the markets closed with a weight of uncertainty, as major U.S. stock indexes drifted lower under the shadow of hawkish voices from the Federal Reserve. Hopes for swift and generous interest rate cuts dimmed, leaving investors restless. The Nasdaq bore the heaviest decline, falling 0.65%, while the Russell 2000 stumbled with its first weekly loss since early August. The S&P MidCap 400 and S&P 500 followed suit, while the Dow Jones Industrial Average held almost steady, though not untouched by the tremors.

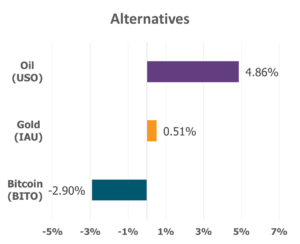

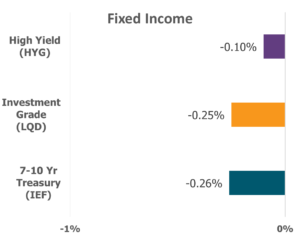

Data Source: Factset® Performance Period: 9/22/2025 to 9/26/2025

Investor confidence wavered, as a chorus of Federal Reserve officials signaled a slower and more measured approach to monetary easing. Chair Jerome Powell cautioned that the nation faces a “challenging situation,” pressed between the weight of inflation risks and the fragility of the labor market. He further acknowledged that “equity prices are fairly highly valued,” echoing an undercurrent of caution that dampened market enthusiasm. St. Louis Fed President Alberto Musalem and Atlanta Fed President Raphael Bostic joined the refrain, warning that inflation’s persistence demands vigilance before relief can be offered.

Still, the economic story was not without glimmers of strength. Inflation, as measured by the Fed’s favored core PCE price index, remained steady—up 0.2% in August, unchanged from July. On an annual basis, the index rose 2.9%, reflecting both resilience and restraint. Meanwhile, personal income and spending edged higher than expected: signs of continued vitality within households. The Bureau of Economic Analysis lifted its estimate of GDP growth for the second quarter to 3.8%, fueled by the steady heartbeat of consumer spending.

Housing, too, carried its own tale of contrast. New single-family home sales surged to their highest level since January 2022, leaping over 20% from July to a seasonally adjusted rate of 800,000 which was well above expectations. Yet existing home sales remained largely flat, down slightly by 0.2% from the prior month. Even so, prices continued their upward march, with the median sales price reaching $422,600, marking the 26th straight month of year-over-year gains.

Across the markets, sectors bore mixed fates. Most declined, weighed down by shifting winds, yet Energy and Utilities surged—rising 4.7% and 2.8%, respectively—bolstered by crude’s climb, natural gas demand, and global calls to wean from Russian oil and gas. Meanwhile, Communications Services and Materials faltered most sharply, at -2.7% and -2.0%.

Such weeks remind us that earthly markets are far from clear, blotted by policy, politics, and swirling clouds amidst rays of confidence. Remember, though ,while stormy skies may persist, His light continues to guide, steady, and sustain.

“The light shines in the darkness, and the darkness has not overcome it.” – John 1:5

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.