-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

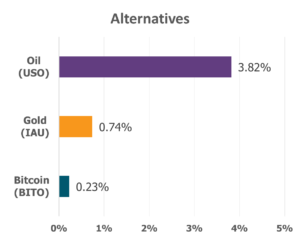

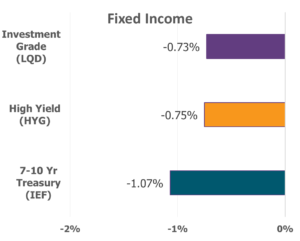

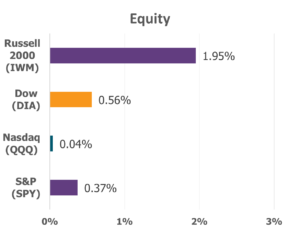

Markets surged to new highs, as investor confidence was lifted by strong economic data and easing inflation concerns. The S&P 500 and Nasdaq gained steadily, with small-cap stocks and cyclical sectors outperforming, reflecting broad-based optimism. Solid expectations for Q2 earnings and resilient consumer demand also helped fuel the rally.

Data Source: Factset® Performance Period: 6/30/2025 to 7/4/2025

Also helping fan the flames was job postings returning to pre-pandemic levels. That said, hiring remains cautious, as lingering concerns over tariffs have many businesses waiting for clearer skies before expanding their workforce. For young Americans, especially recent graduates, the road to full-time employment remains steep. Still, even in this tension, the labor market steadily presses on. In June, the U.S. added a solid 147,000 jobs, beating expectations by 32,000, and the unemployment rate ticked down to 4.1%. While about half of those new roles came from state and local governments, and private sector hiring marked its slowest pace in eight months, the broader trend reflects a labor market still determined to move forward.

Not to be outdone, the signing of the “Big, Beautiful” budget reconciliation bill further brightened the horizon. This sweeping legislation brings with it the promise of new infrastructure projects, expanded tax incentives, and a renewed wave of investment which could reignite hiring across sectors. America’s workers may soon find themselves called to build, again, on bridges, in factories, and throughout the fields of innovation.

Supporting this momentum is the manufacturing sector showing signs of revitalization. According to the U.S. Census Bureau’s July 3rd report, new orders for manufactured goods rose by 8.2% in May, adding $48.5 billion and reversing April’s decline. It marks the fifth gain in six months, suggesting renewed industrial demand. Shipments and inventories inched up modestly, but a 3.4% surge in unfilled orders points to a backlog of business activity waiting to be fulfilled. Whether companies are front-loading ahead of tariffs or renewing their commitments to investment, one thing is clear: demand is firm, factories are humming, and momentum is building.

Amid shifting tides, a quiet strength is unfolding across the American economy—a reminder that progress often comes not in leaps, but in steady steps.

“The Lord makes firm the steps of the one who delights in him; though he may stumble, he will not fall, for the Lord upholds him with his hand.” — Psalm 37:23–24

Let us move forward with faithful hands and hopeful hearts.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.