-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

Amid the noise of uncertainty, last week delivered a welcomed rhythm of reassurance, in an encouraging blend of growth, resilience, and progress. While U.S. GDP started the year on a softer note largely due to a temporary surge in inventories, the second quarter now appears poised to deliver growth exceeding 3%. This momentum is powered by the quiet strength of American households, with consumption forecast to grow at a steady 1.7% annual pace. Even as surveys have reflected shaky sentiment, faith in provision is bearing fruit in real behavior. Consumers continue to spend with confidence, buoyed by steady jobs and restrained inflation.

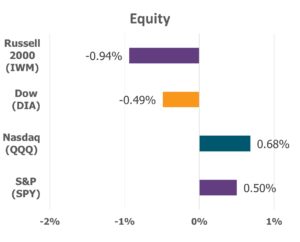

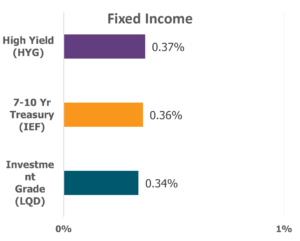

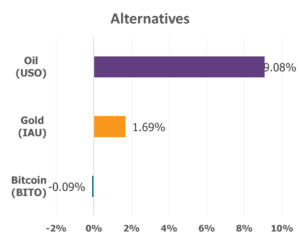

Data Source: Factset® Performance Period: 6/9/2025 to 6/13/2025

Though hiring has cooled, unemployment remains anchored near 4.2% — well below its historical average. This labor market is defined not by a frenzy of new hires, but by a faithful commitment to retention, as companies prioritize keeping the talent they trust. Wages are quietly outpacing inflation at 3.9%, a subtle but powerful tailwind for households. When people feel secure in their careers and see their work rewarded, they tend to build, invest, and give with open hands. It’s the kind of economic atmosphere that stirs not just confidence, but gratitude.

Inflation, once a roaring fire, now flickers at manageable levels. May’s consumer and producer price indexes both surprised to the downside with CPI (Consumer Price Index) at 2.4% and PPI (Producer Price Index) at 2.6%, a dramatic fall from their 2022 peaks. The journey from crisis to calm hasn’t been easy, but steady stewardship has brought us closer to the Federal Reserve’s 2% target. Even market behavior reflects this shift in tone. After a 20% drop earlier this year, the S&P 500 has roared back with a nearly full recovery.

Still, the world remains turbulent. Geopolitical tensions in the Middle East recently pushed oil prices up 5 to 7%, reminding us of the fragility of global peace. Yet even here, there is grace. The U.S., now a net energy exporter, is less vulnerable to oil shocks than ever before. That shield is strengthened by leaders like Constellation Energy, the nation’s largest provider of carbon-free power. With nearly 90% of its production emissions-free and an 80% reduction in its carbon footprint since 2005, Constellation embodies what it means to lead with purpose. Their commitment to sustainable, reliable energy reflects a broader calling to steward creation well, for today and for generations to come.

In these times, we are reminded that even when uncertainty rises, our foundation can remain unshaken. As Scripture promises, “You will keep in perfect peace those whose minds are steadfast, because they trust in You.” – Isaiah 26:3. Let us press on; watchful, grateful, and anchored in hope.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.