-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

Markets stood on edge this week, as Treasury yields held steady, reflecting a tense balance between escalating U.S.-China trade tensions and cautious optimism. The 10-year yield remained at 4.401%, while the 2-year rose to 3.821%, signaling short-term unease. China warned nations against siding with the U.S., deepening concerns of an economic rift. Yet Treasury Secretary Scott Bessent offered a ray of hope, signaling that trade de-escalation is coming, even though a final deal could still be years away.

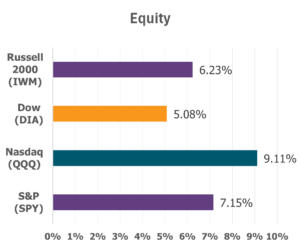

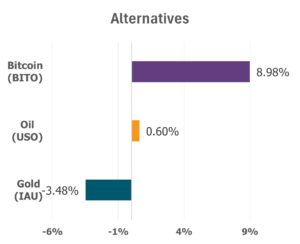

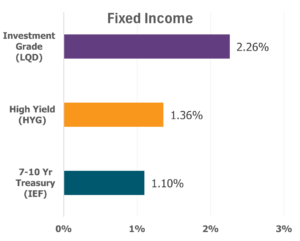

Data Source: Factset® Performance Period: 4/21/2025 to 4/25/2025

Meanwhile, the administration rattled markets by attacking — then defending — Fed Chair Jerome Powell, and hinting that China tariffs might be cut from 145% to as low as 50%–65%,if Beijing reciprocates. In a landscape shaped by mixed signals and fragile sentiment, Treasury yields may be flat, but uncertainty runs deep.

Cooling, Not Crashing

The economic warning lights are flashing once again. In March 2025, the U.S. Leading Economic Index® (LEI) dropped 0.7% to 100.5, its sharpest monthly fall in a year, intensifying fears of a slowdown. Driving the drop: weakening consumer confidence, the worst stock sell-off since 2022, and a slowdown in manufacturing orders, all exacerbated by tariff fears. “The data signals a cooling economy, not a collapsing one,” noted Justyna Zabinska-La Monica of The Conference Board. Still, the group lowered its 2025 GDP forecast to 1.6%, as rising trade tensions threaten to fuel inflation, strain supply chains, and dampen hiring. The U.S. may sidestep recession for now, but the test ahead looks increasingly difficult. Services PMI plunged to 51.4 in April, its sharpest drop in a year, while manufacturing edged up to 50.7, buoyed by domestic demand as exports sank under tariffs and a weaker dollar.. Durable goods orders jumped 9.2% for March, led by a 139% spike in aircraft, as businesses scrambled to buy ahead of looming tariffs. The Fed confirmed the rush was tactical, not sustainable. Yet, jobless claims remained steady at 222,000, signaling labor market resilience in a tense economic moment.

March existing home sales fell 5.9% to a six-month low of 4.02 million, the weakest March since 2009. Buyers pulled back amid economic uncertainty, dashing hopes for a recovery. Prices hit a March record at $403,700, matching new home prices, which is a rare event. Luxury homes defied the trend, with $1M+ sales up 13.8%, while first-time buyers made up 32% of sales. Despite the chill, cash-rich and high-end buyers kept the market moving, if just barely.

Looking Ahead: Testing the Economy’s Nerve

As markets navigate a precarious blend of geopolitical strain and fragile economic signals, next week’s data could prove pivotal. All eyes will turn to the U.S. employment report, a key test of labor market resilience amid signs of cooling activity. Unemployment levels, hourly wages, and job creation numbers will offer critical insight into whether businesses are pulling back or holding firm. Additionally, personal income and spending figures, alongside the PCE price indexes which is the Fed’s preferred inflation gauge, will help determine how households are responding to rising costs and uncertainty.

Amongst the chaos, Amphenol Corporation is charting a bold and inspiring path forward; anchored in innovation, resilience, and vision. The Connecticut-based interconnect solutions leader recently saw its shares surge 12%, signaling a renewed wave of investor confidence. From defense and automotive to mobile and industrial sectors, Amphenol’s advanced systems, sensors, and antennas are helping power the digital age. As demand soars in areas like cloud computing and generative AI, Amphenol continues to deliver posting a record $4.8 billion in Q1 2025 sales, up 48% year-over-year. In a world searching for connection and clarity, Amphenol stands tall while bridging progress with purpose.

Held by the One Who Holds It All

In times of economic uncertainty, when headlines shift by the hour and markets walk a tightrope of tension and hope, we are reminded that our true foundation is not built on forecasts or financials. “Blessed is the man who remains steadfast under trial, for when he has stood the test he will receive the crown of life, which God has promised to those who love him.”

Just as James 1:12 promises a blessing for those who endure with steadfast faith, we too are called to walk with focus, patience, and trust. Though the path may be narrow and the winds strong, we do not journey alone. Our confidence is not in the calm, but in Christ who commands the storm.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.