-

-

275 Hess Boulevard

Directions

Lancaster, PA 17601 -

Call

717.560.8300 -

Fax

717.833.6303

- contact us

Financial Services

![]() Last week, markets continued their downward spiral, clawing back only a portion of their losses by Friday’s close. Amid the turbulence, certain sectors managed to stand their ground, with Utilities and Energy emerging as the rare winners in a sea of red. Conversely, Consumer Discretionary and Communication Services bore the brunt of investor anxiety. Even as volatility reigns supreme, the resilience of companies reminds us that while markets may falter in the short term, enduring value persists.

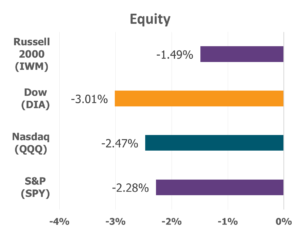

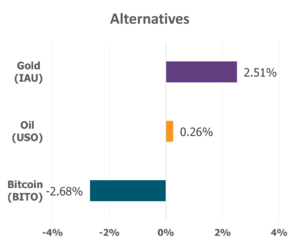

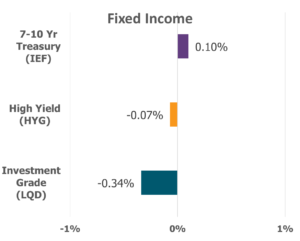

Last week, markets continued their downward spiral, clawing back only a portion of their losses by Friday’s close. Amid the turbulence, certain sectors managed to stand their ground, with Utilities and Energy emerging as the rare winners in a sea of red. Conversely, Consumer Discretionary and Communication Services bore the brunt of investor anxiety. Even as volatility reigns supreme, the resilience of companies reminds us that while markets may falter in the short term, enduring value persists.

Data Source: Factset® Performance Period: 3/10/2025 to 3/14/2025

On the economic front, last week’s calendar was a mixed bag—tempered by disappointment but punctuated with glimmers of optimism. The week began with the release of February’s NFIB Small Business Optimism Index, which fell short of expectations, registering a modest 100.7, as ongoing uncertainty kept business confidence subdued. Nevertheless, the labor market revealed itself to be a pillar of relative strength. January’s job openings slightly exceeded forecasts at 7.7 million, and initial jobless claims for the week aligned with expectations—both pointing to a labor force that, for now, remains steady amid macroeconomic headwinds. Midweek, investors received encouraging news on the inflation front. Both the Consumer Price Index (CPI) and Producer Price Index (PPI) came in softer than anticipated. The CPI rose a modest 0.2% month-over-month, marking a 2.8% annual increase—nudging ever closer to the Federal Reserve’s elusive 2% target. Meanwhile, the PPI remained flat in February, reflecting a 3.2% rise over the year. However, not all news was comforting: by week’s end, consumer sentiment plummeted to its lowest level in over two years, as inflationary fears and uncertainties surrounding economic policy weighed heavily on public perception.

Looking ahead, this week promises to be pivotal, packed with economic releases that will test the market’s resolve. Chief among them is the Federal Open Market Committee’s (FOMC) interest rate decision on Wednesday—a moment investors will watch with keen anticipation. Balancing persistent inflation with a resilient labor market, the Fed’s choice could set the tone for months to come. Meanwhile, fresh data on homebuilder confidence, housing starts, building permits, and existing home sales will offer critical insights into the housing market—a sector that has weathered turbulent waters of late. Complementing these will be releases on retail sales, business inventories, and industrial production—painting a broader picture of the nation’s business health. Wrapping up the week, the U.S. Leading Economic Indicators report will aim to shed light on the economic horizon, offering a compass for what may lie ahead.

Amid all this uncertainty, it’s crucial to take a step back and remember the value of a long-term perspective. Take, for instance, Palantir Technologies. Over the past month, Palantir’s stock has been caught in the downdraft, tumbling over 20%, as investors react to broader market jitters. And yet, “zooming out” our perspective reveals a much different story: over the past year, Palantir’s shares have surged more than 200%.Although Palantir may be an outlier, its journey is a testament to the power of long-term conviction in innovative companies. As artificial intelligence continues to revolutionize industries, Palantir remains at the forefront—providing crucial tools for businesses and governments alike to harness the power of data.

Ultimately, Palantir’s story echoes a timeless lesson, well captured in the words of Proverbs 13:11: “Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.” In other words, while markets may be tempestuous in the short term, the wisdom of patience and discipline often reward those who stay the course.

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights

Sources: Yahoo Finance, Reuters.com, and JP Morgan Market Insights. Securities offered through Osaic Wealth, Inc. member FINRA/SIPC. Investment advisory services offered through Faithward Advisors LLC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth. Dream More, Plan More, Do More is a registered trademark of Faithward Advisors, LLC, Reg. U.S. Pat. & Tm. Off. Any opinions expressed in this forum are not the opinion or view of Faithward Advisors or American Portfolios Financial Services, Inc. (APFS). They have not been reviewed by either firm for completeness or accuracy. These opinions are subject to change at any time without notice. Any comments or postings are provided for informational purposes only and do not constitute an offer or a recommendation to buy or sell securities or other financial instruments. Readers should conduct their own review and exercise judgment prior to investing. Investments are not guaranteed, involve risk and may result in a loss of principal. Past performance does not guarantee future results. Investments are not suitable for all types of investors.